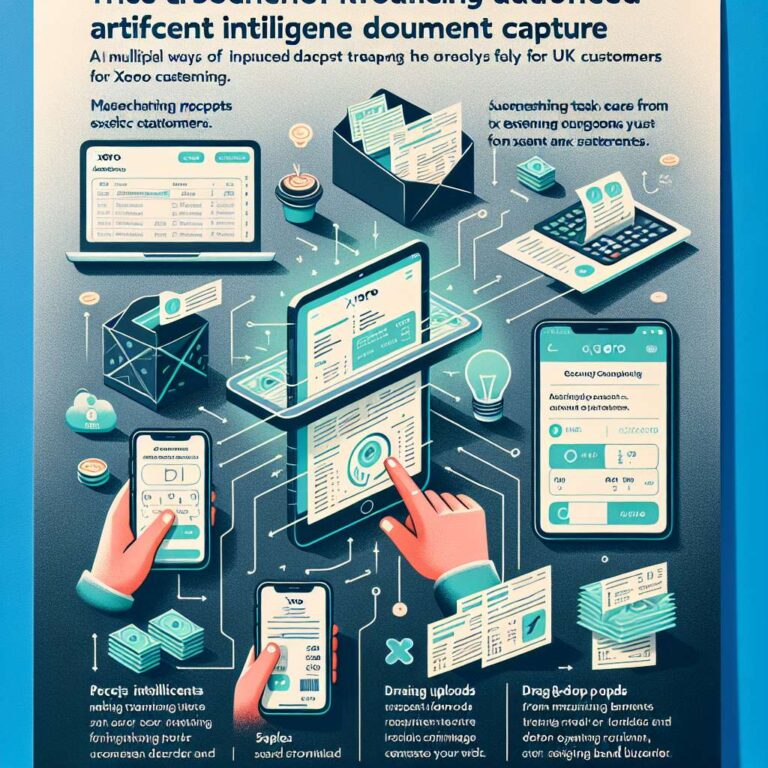

Xero is introducing artificial intelligence powered data capture and extraction directly into its platform for UK customers, with rollout scheduled over the first two weeks of March. The capability will be available at no extra cost to customers on all business edition plans and will allow users to snap photos of receipts in the Xero Accounting app, email documents to a dedicated address, or drag and drop files via the web. The upgrade represents a major transformation of Xero’s document management capabilities and is positioned as a way to streamline how small businesses and their advisers handle financial records.

The launch is timed to coincide with a looming regulatory shift in the UK. On April 6th, HMRC’s Making Tax Digital for Income Tax (MTD for IT) mandate comes into effect, requiring a large number of small businesses, sole traders, and landlords to keep digital records of income and expenditure, submit quarterly updates and a final annual submission to HMRC using compatible software. By embedding advanced large language model technology to extract data, Xero will now be able to read receipts, sales invoices and landlords’ rental statements captured by the user in under 20 seconds, saving time that was previously spent manually entering data. The technology is intended to provide an enhanced level of accuracy and create pre populated digital records directly within Xero, making one of the most critical parts of compliance more effortless.

Once documents are captured, Xero will automatically suggest which existing bank transactions match these records, leaving customers to review and approve matches. Xero’s UK managing director Kate Hayward said many businesses are still trying to understand the requirements around Making Tax Digital, but with artificial intelligence users no longer have to enter data manually and can worry less about mistakes, with the ability to simply snap and capture in seconds helping them stay on top of their finances more easily. The March release is the first set of capabilities and will be launched initially in the UK before expanding to other markets. In the coming months, Xero plans to add further artificial intelligence powered bookkeeping automation and insights directly into the platform to help customers work smarter and more efficiently, building on its position as a global small business platform trusted by millions of small businesses, accountants and bookkeepers.