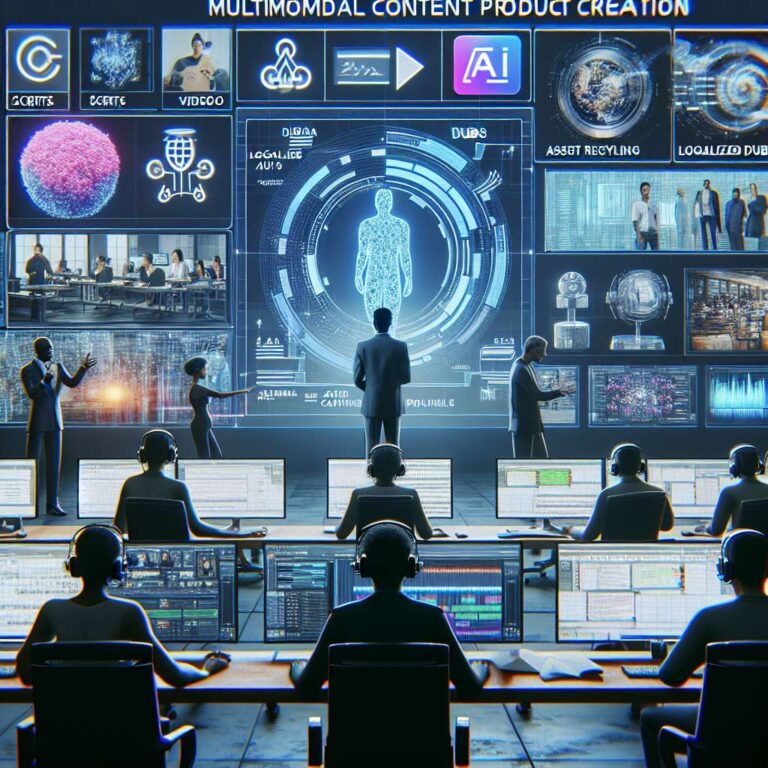

The article explains how multimodal content creation pipelines are transforming media production by unifying previously fragmented tools into coordinated workflows. Creators who once stitched together multiple applications can now generate scripts, video drafts, images, captions, and localized dubs from a single prompt, shrinking production cycles from weeks to hours for many of the economy’s 50 million creators. Video Artificial Intelligence workflows allow solo producers to release polished clips without traditional crews, which broadens creator monetization across global platforms but also accelerates legal and ethical pressures that regulators and unions are still scrambling to address.

Market forces are driving rapid adoption as the creator economy scales and demands faster, more personalized media. Grand View Research values the 2024 creator economy at USD 205.3 billion, and analysts expect double-digit CAGR through 2030 as short-form and tailored content proliferate. Multimodal content creation pipelines align with this growth by collapsing text, image, and audio generation into single calls, lowering friction and making sophisticated capabilities accessible to small teams without large software budgets. Tools such as OpenAI’s GPT-4o mini, Adobe’s Firefly-infused Creative Cloud, and video-centric apps like Runway, Descript, and Synthesia illustrate how integrated multimodal systems and falling API prices are rewriting everyday workflows and making speed and flexibility a core competitive advantage.

The article details how these pipelines recycle assets across formats, such as using an Instagram reel transcript to auto-generate blog posts, thumbnails, and podcast narration, with Canva’s CSV-driven templates enabling thousands of variants overnight so small brands appear omnipresent without increasing headcount. Platform and tool providers form layered ecosystems, from foundation model vendors to creative suites and specialist video Artificial Intelligence tools. Adobe’s survey found 86% of 16,000 creators already use generative features inside its suite, and 85% would delegate repetitive edits to an Artificial Intelligence agent that learns their style, while OpenAI’s Assistants API lets developers wrap multimodal reasoning into custom production bots embedded in CMS and e-commerce systems. Economically, studios report 2-3× content output after workflow integration, localized assets increase international watch time by double-digit percentages, and lower rendering costs raise profit margins, enabling revenue from ad-supported content, avatar licensing, synthetic dubbing, and template sales, even as platform commissions and algorithm volatility still threaten stability.

Alongside these gains, legal and ethical challenges intensify as copyright lawsuits target model training on protected works and industry groups seek damages, while union contracts like SAG-AFTRA’s require explicit consent for synthetic voices and likenesses. Multimodal content creation pipelines make impersonation easier, so creators must manage rights metadata, consent tracking, and quality control to avoid hallucinated captions or mismatched dubbing that erode trust, as regulators explore disclosure labels and audit trails. The skills landscape stretches beyond storytelling to include prompt engineering, agent orchestration, pipeline debugging, and comprehension of platform terms and legal frameworks, with credentials such as the Artificial Intelligence Network Security certification positioned as a way to validate expertise. Ultimately, the article argues that multimodal content creation pipelines now underpin creator economy growth by compressing timelines and diversifying revenue while heightening platform dependence and legal uncertainty, and it urges creators to refine their pipeline strategies, deepen skills, monitor policy shifts, and secure certifications to stay competitive in the next phase of media.