The article examines how the core dynamic of the current Artificial Intelligence boom, the repeated 10X expansion of large language model size, is colliding with physical and financial limits. After successive generations where increasing parameter counts unlocked new capabilities, developers are now discovering that, somewhere in the trillions of parameters, existing semiconductor fabrication capacity and data center infrastructure are not sufficient to support another 10X leap. The author argues that these bottlenecks push the Artificial Intelligence industry into “uncharted territory” where new approaches to technology, financing and regulation will be required, and where decisions taken now will shape both financial markets and broader society.

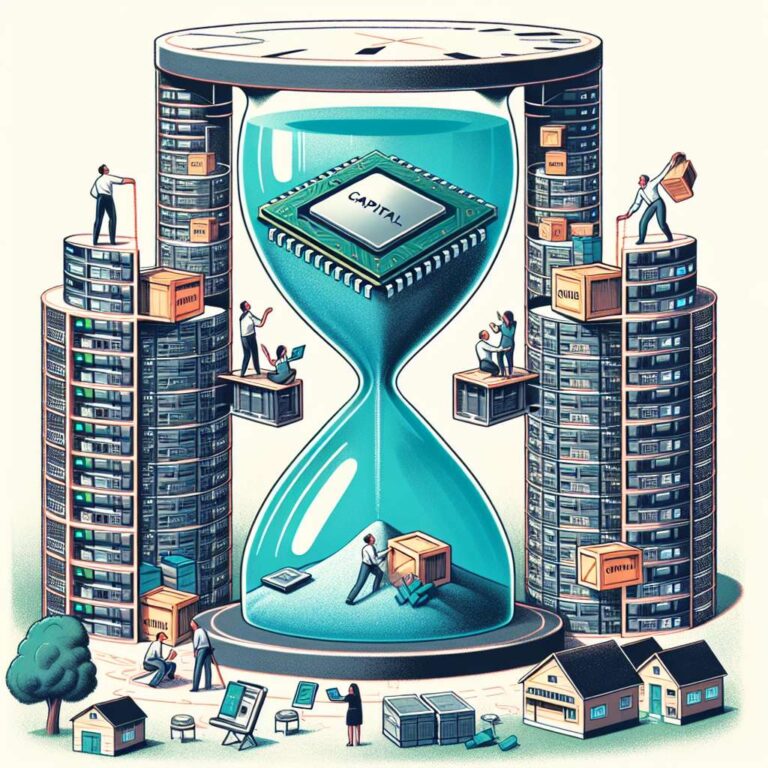

In response to the chip constraint, the United States and China are pursuing sharply diverging strategies. Shut out from the most advanced Artificial Intelligence chips, China’s government has funded approximately 20 state backed firms to build open weights models, hoping to offset weaker hardware through software innovation and wide sharing. By contrast, United States frontier model companies are doubling down on proprietary systems and more powerful hardware, with firms like Nvidia announcing new generations of chips and an “AI Factory” rack architecture that requires twice the power and twice the cooling of current racks. The scale of required investment has “risen well into the trillions of dollars,” pushing beyond what any single company can finance and encouraging zaibatsu like alliances among technology and semiconductor firms, even as the outlines of clear rival blocs remain uncertain.

The author then assesses systemic financial risk, drawing parallels to past transitions such as the industrial revolution and the internet bubble but concluding that a complete collapse of the Artificial Intelligence ecosystem is improbable. Large incumbents may struggle to fund the next 10X step or stumble commercially, shrinking as IBM once did, while pure start ups are more likely to face mergers, valuation collapses and investor losses that remain contained rather than contagion inducing. Semiconductor makers, accustomed to volatile cycles, could see stock price setbacks if frontier customers delay orders, but persistent demand for Artificial Intelligence chips should limit systemic fallout. Across the wider infrastructure and application stack, normal start up failure rates are expected, moderated by the slow pace of deep technical shifts, which in semiconductors takes approximately three years or more.

More serious risks, the article contends, stem from how financing and automation interact with households and employment. A 10X surge in funding needs is encouraging efforts to weaken post crisis safeguards, including steps by the United States administration to expand retail access to private markets. The danger is that large numbers of small investors, lacking hedging tools and risk expertise, could suffer crippling losses in high risk funds, with knock on effects on mortgages, credit card debt and other obligations reminiscent of the great recession. At the same time, estimates for Artificial Intelligence driven job loss range from “20% of jobs” being eliminated with offsetting creation, to scenarios where “80% or more” are automated with few new roles, raising the prospect that frightened or unemployed consumers could sharply cut spending and trigger a serious economic disruption.

Beyond immediate market concerns, the piece highlights the emerging concentration of power in a small cluster of interlinked United States frontier model companies, especially if the United States “horse” in the Artificial Intelligence race beats China. Each successive 10X step could further consolidate this power, potentially leading to a single dominant company or keiretsu because only one organization might be able to marshal the necessary capital. That prospect raises questions of antitrust, natural monopolies and whether some Artificial Intelligence infrastructure should be treated as a public utility, not only within national legal systems but through international efforts led by bodies like the United Nations and proposals from China that reference nuclear governance. The article concludes that understanding the financial and technological power of frontier Artificial Intelligence is essential to designing policies that maximize benefits, limit harms and respond to widening wealth gaps, much as financial markets once had to adapt to the shift from agrarian economies to industrial societies.