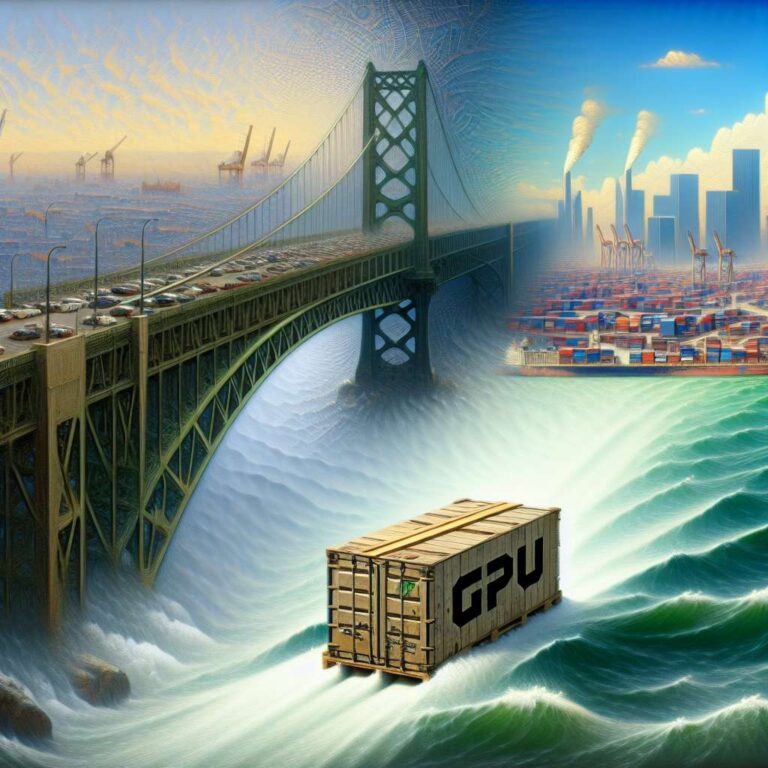

NVIDIA has been thrust into the heart of the global semiconductor struggle, caught between U.S. export controls and China´s intense demand for advanced chips. The company took a dramatic step by removing China from its revenue forecasts, a move that quickly reflected in a sharp 12.5% revenue drop in Q1 2026 from the Chinese market. This shift followed increasingly restrictive U.S. regulations aimed at throttling China’s access to cutting-edge Artificial Intelligence processors. NVIDIA´s CEO Jensen Huang vocally criticized the export policy´s efficacy, arguing it inadvertently accelerates the rise of Chinese rivals like Huawei, further complicating the competitive landscape.

To offset these losses, NVIDIA is rapidly pivoting towards Europe, seeking to entrench itself as the backbone of the continent´s sovereign Artificial Intelligence infrastructure. Strategic collaborations now span more than a dozen European Artificial Intelligence consortia and telecom firms, all leveraging NVIDIA’s powerful Grace Blackwell GPUs. The aggressive European expansion is buoyed by the EU’s €20 billion fund targeting Artificial Intelligence super-factories, aiming for a tenfold leap in compute capacity by 2026. Flagship projects in Germany and France—such as industrial-scale cloud builds and large language model platforms—underscore this new direction as Europe’s data center GPU market is projected to surge, with NVIDIA positioned to capture a dominant share through its integrated hardware and enterprise software offerings.

However, significant risks loom. U.S. export rules remain fluid and unpredictable, and while non-Artificial Intelligence chips could see easier access, top-tier Artificial Intelligence hardware is still tightly controlled. Meanwhile, should China’s domestic chip sector achieve rapid gains, or if U.S. policy reverses, NVIDIA could face abrupt market shifts. Competitors like AMD and Intel, with less exposure to Chinese headwinds, might benefit if the geopolitical winds change. Investors are urged to recognize NVIDIA’s unmatched leadership in Artificial Intelligence infrastructure—evidenced by soaring annual revenues and robust data center growth—while also hedging against regulatory volatility and overexposure to China-connected semiconductor stocks. Ultimately, NVIDIA’s strategic migration toward Europe is transforming adversity into opportunity, but sustained outperformance will demand vigilance as geopolitical forces continue to reshape global technology supply chains.