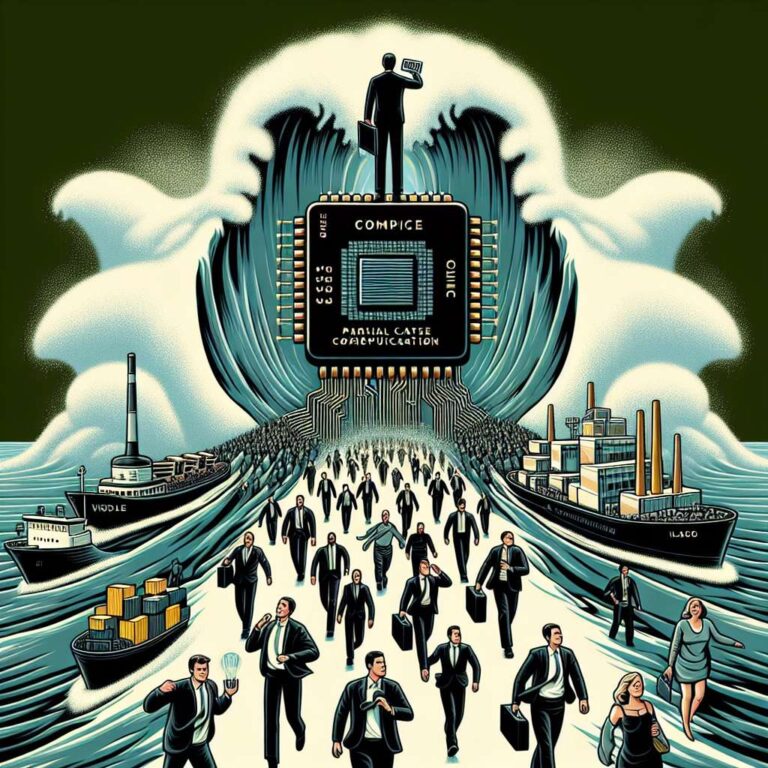

Since generative Artificial Intelligence captured attention in 2022, investors have poured money into Nvidia on the expectation that its lead in hardware will translate into outsized profits. The company has seen a dramatic run-up in market value and is on course to report more net income this year than its two main rivals will record in sales combined. That momentum has been reinforced by a wave of multi-billion-dollar data centre investments, even as some industry observers warn that rapid spending and inflated deals could outpace the real commercial use cases for the technology.

Nvidia’s edge rests on its GPU heritage and a sequence of product families adapted for Artificial Intelligence workloads. The Hopper generation and its successor, Blackwell, were evolved from graphics chips and tuned for the parallel computation needed to train and run large neural networks. Nvidia says Blackwell delivers roughly 2.5 times the training performance of Hopper and ships in configurations from single cards to massive arrays. The company also packages chips into systems such as the GB200 superchip, which pairs two Blackwell GPUs with a Grace central processing unit, and provides software and clustering tools that let customers deploy large pools of accelerators quickly.

Competition and geopolitics are the main tests to Nvidia’s lead. Market research firm IDC estimates Nvidia controls about 90 percent of the data centre GPU market. Rivals are responding: AMD has pitched its Instinct family and a next-generation MI450 that has already been included in plans by Oracle and OpenAI, and Intel is retooling its strategy though it lacks a direct competitor in the near term and is cooperating with Nvidia on some combined products. Nvidia has signalled a willingness to open its NVLink server backbone to third parties. At the same time, export controls and national responses have complicated sales to China; Nvidia recorded an inventory writedown tied to a US ban on a pared-back H20 chip, and chief executive Jensen Huang has lobbied Washington to ease restrictions to avoid ceding technological leadership.