Nvidia (NVDA) has experienced a notable drop in its stock value, losing nearly 6% on Wednesday followed by an additional 2% on Thursday. The downturn follows announcements from the Trump administration about new export curbs impacting the semiconductor industry. Despite these setbacks, Nvidia´s stocks appeared to stabilize as discussions suggested that tariffs might not be implemented on April 2 as initially feared.

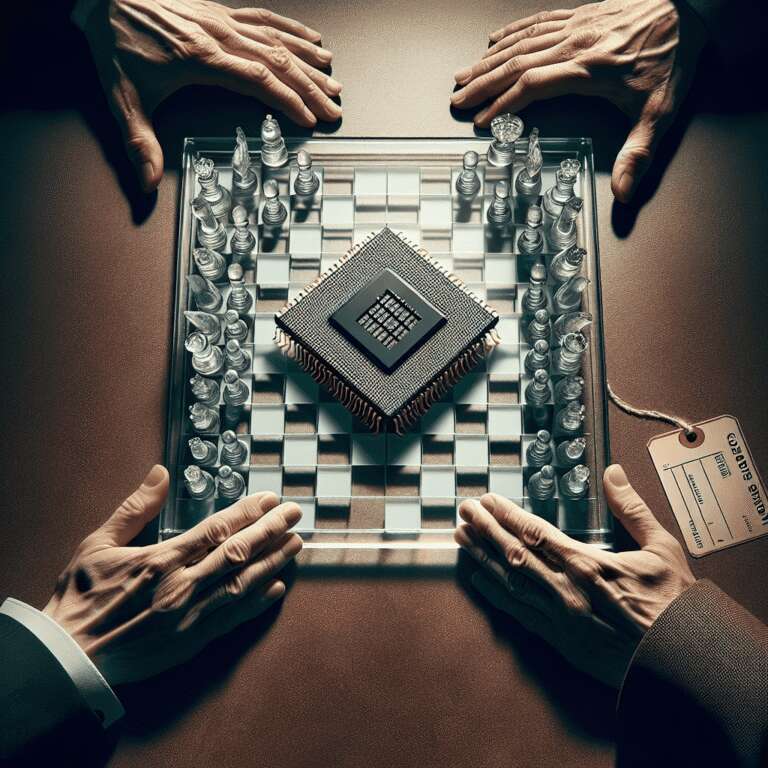

The Trump administration´s policy is expected to significantly impact Nvidia, especially given its substantial market presence in the semiconductor sector. Furthermore, the tariffs and export restrictions could lead to broader implications for tech industries, potentially disrupting supply chains and affecting global market dynamics.

Investors are carefully considering Nvidia´s position, assessing whether the company remains a viable long-term investment despite current market pressures. The company´s focus on Artificial Intelligence and other advanced technologies continue to position it as a major player in the tech landscape, but with geopolitical strategies influencing the market, stakeholders are adopting a cautious approach to its stock.