The article examines how large enterprises are moving beyond experimental artificial intelligence pilots to sustained usage that delivers measurable value. Three Bain Capital Ventures CTO advisory board members, Franziska Bell of Ford, Sandeep Chouksey of Mammoth Brands, and Ben Kus of Box, describe a landscape where many organizations now use artificial intelligence in at least one business function, yet often struggle to scale pilots or see clear returns. They argue that what may appear as slow progress is instead a necessary period of experimentation, given the disruptive nature of the technology and the need to embed it into day-to-day work rather than impose it from the top down.

All three leaders emphasize cultural and organizational tactics that help employees adopt artificial intelligence tools. At Ford, Bell describes adoption as occurring organically, with about 50,000 people actively using the internal Ford LLM platform weekly, supported by a multidisciplinary team embedded in business units to translate needs into practical applications. At Mammoth Brands, Chouksey highlights a culture of curiosity, where teams are encouraged to run agile artificial intelligence pilots with a wide range of partners, supported by fast-tracked legal and security reviews and a task force of artificial intelligence champions who share best practices. At Box, Kus notes that the company began with a company-wide artificial intelligence certification course and a leadership stance that avoids dictating specific use cases, instead providing tools, guardrails, and forums for employees to share how they are enhancing daily work.

The case studies show tangible use cases where artificial intelligence is already reshaping workflows. Ford has a dozen “AI Big Bets” tied to corporate strategy, including a multi-agent supply chain risk-assist system and generative design tools that convert manual sketches into 2D or 3D renderings, while proprietary models cut aerodynamic drag simulations that used to take 16 to 18 hours down to seconds. Mammoth Brands uses tools on top of its data warehouse to let non-technical staff query business performance, and a generative tool that parses unstructured data from hundreds of emails and PDFs to streamline supply chain decisions. Box rolled out early Box agents for unstructured data across the company and found strong adoption in precise functions such as procurement, compliance, and audit, where teams automated fact-finding across large document sets.

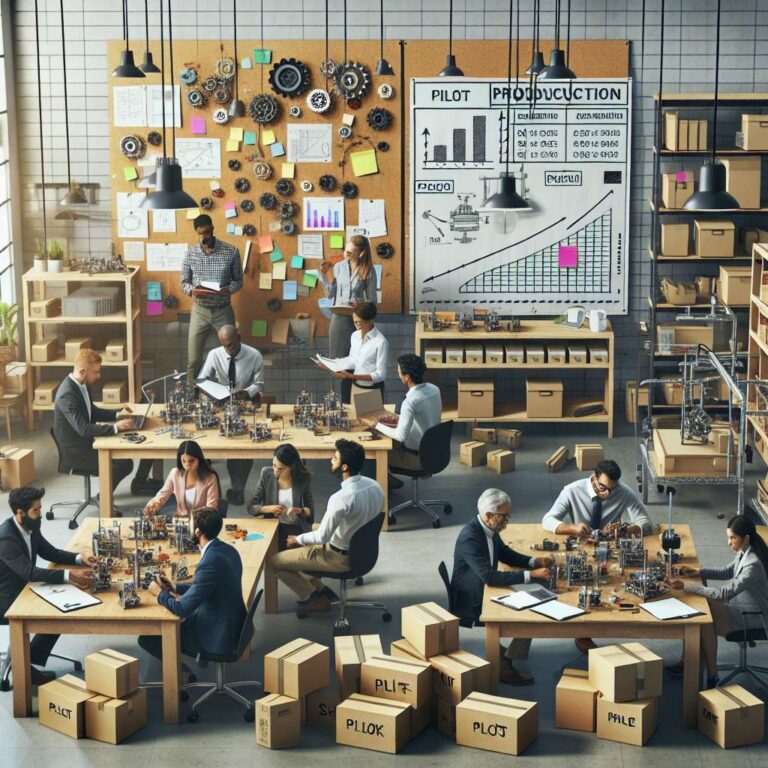

Measuring value remains a nuanced challenge, and the executives caution against rigid financial expectations too early. Bell explains that Ford’s “AI Big Bets” undergo stringent financial analysis but are also evaluated on agility, speed, and the ability to free experts to focus on higher-value work. Chouksey notes that Mammoth Brands piloted over 30 new artificial intelligence tools in 2025, many of which failed by design, because the priority was rapid learning before enforcing strict return on investment thresholds, with successful tools later absorbed into departmental budgets. Kus supports tracking return on investment but warns that with artificial intelligence evolving so fast, it is unwise to cut programs after a few months without proven impact, since experimentation itself is key to long-term success.

The leaders also detail how they buy and evaluate artificial intelligence technologies in a fluid vendor ecosystem. Ford prefers off-the-shelf solutions that meet stringent cybersecurity requirements and integrate with its predominantly Google-based cloud infrastructure, while remaining open to smaller vendors with innovative capabilities. Mammoth Brands has no bias toward incumbent software providers and procured all those 30 tools from vendors, with two-thirds originating from companies with fewer than 100 employees, provided they meet basic security and compliance standards and are willing to treat the brand as a design partner. At Box, Kus observes that the last 12-18 months have brought “every flavor” of artificial intelligence technology, making traditional procurement processes less relevant; instead, Box looks for vendors who offer focused, high-quality tools and can adapt quickly as models improve and artificial intelligence agents gain sophistication.