Chinese authorities have issued guidance requiring new data centre projects that received any state funds to use domestically made artificial intelligence chips, two sources told Reuters. Projects less than 30% complete have been ordered to remove installed foreign chips or cancel purchases, while more advanced projects will be considered on a case-by-case basis, the sources said. The guidance was described by unnamed officials because of the sensitivity of the matter, and it is unclear whether the instruction is nationwide or limited to some provinces.

The order is likely to affect major foreign suppliers of data centre chips, including Nvidia, AMD and Intel. Reuters sources said the guidance covers Nvidia’s h20 chips and also references more powerful processors such as the b200 and h200. While the b200 and h200 are barred from being shipped to China under U.S. export controls, Reuters reported they remain accessible in the country through grey-market channels. Nvidia said its current share of the Chinese artificial intelligence chip market is zero compared with 95% in 2022, according to the company.

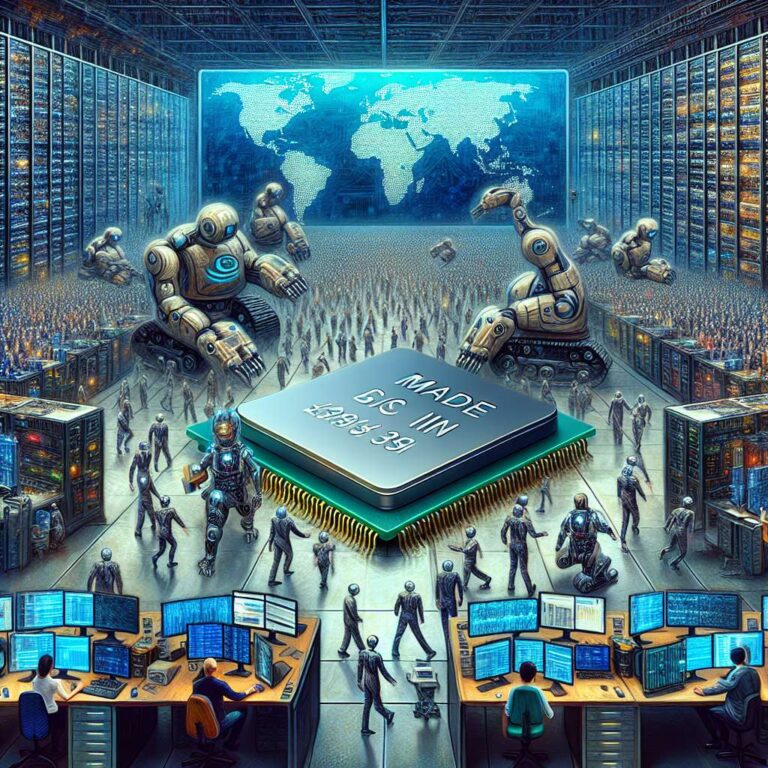

Beijing is positioning the move as part of a broader push to eliminate foreign technology from critical infrastructure and to cultivate domestic chipmakers. The article names Huawei, Cambricon, MetaX, Moore Threads and Enflame among local firms that could gain market share. Some state-funded projects have already been suspended, including a facility in a northwestern province that had planned to deploy Nvidia chips. The Cyberspace Administration of China and the national development and reform commission did not respond to Reuters requests for comment; Nvidia and AMD did not respond and Intel declined to comment.

The policy follows earlier steps by Beijing to discourage purchases of advanced foreign chips, to showcase data centres running solely on domestic chips and to ban Micron products from critical infrastructure in 2023. Reuters noted U.S. measures have justified restrictions by alleging the Chinese military could use the chips, and that leading Chinese manufacturers face supply constraints because U.S. sanctions on semiconductor manufacturing equipment have affected advanced production capacity at foundries such as SMIC.