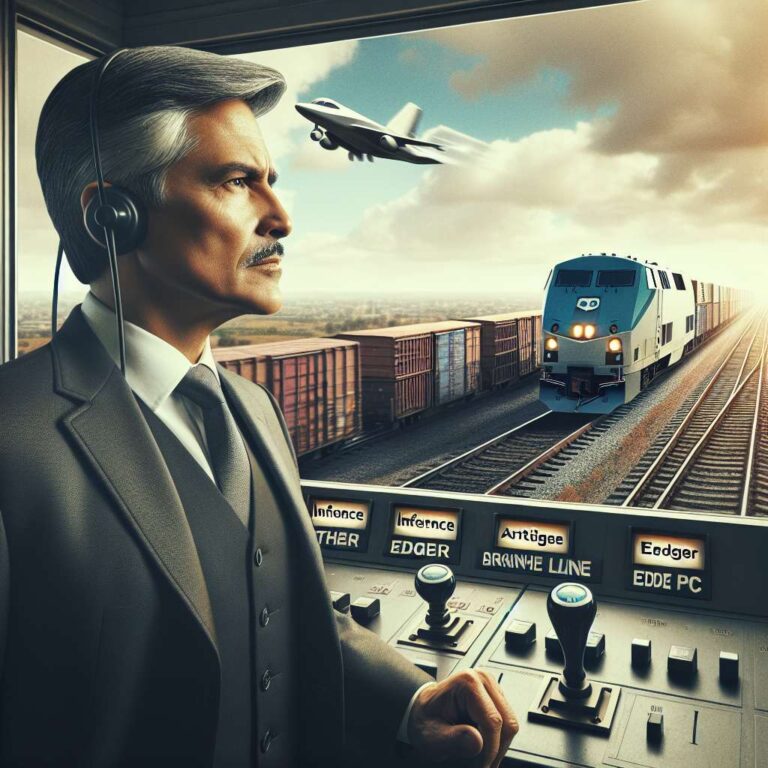

The article examines whether Intel can reestablish itself as a significant player in artificial intelligence compute after missing the initial wave dominated by Nvidia and increasingly AMD. Rather than asking if Intel can beat Nvidia in the short term, it focuses on where Intel can realistically compete: inference in data centers, enterprise and regulated artificial intelligence deployments, edge devices, and artificial intelligence PCs. The author notes that the broad label of “artificial intelligence chips” actually covers multiple markets, from frontier model training and large-scale inference to private enterprise infrastructure and local accelerators in consumer hardware.

Intel’s core advantage is its entrenched x86 server presence and role of CPUs in artificial intelligence-heavy systems. Even in environments saturated with GPUs, CPUs still orchestrate workloads, prepare data, route requests, and handle many inference tasks. Intel is betting that a large share of artificial intelligence workloads, especially smaller and mid-sized models, cost-sensitive inference, and stability-focused enterprise deployments, do not require expensive GPUs everywhere. In this view, Intel does not need to displace GPUs to benefit from artificial intelligence growth; it needs to be sufficiently competitive in enough scenarios to sell substantial CPU and accelerator volume.

The piece highlights Gaudi 3 as Intel’s main artificial intelligence accelerator, describing it as solid hardware that can look attractive in certain inference and throughput-focused use cases when price and power efficiency are included. However, the limiting factor is software ecosystem and adoption. Developers overwhelmingly target Nvidia’s CUDA first, and moving to a different stack demands deliberate effort, so Gaudi 3 is positioned to win targeted, cost-driven inference deals rather than becoming an industry default. A key signal of Intel’s strategy is its decision to pull back from selling its most ambitious training accelerator as a full market product and reframe it as an internal test platform, which the author interprets as an acknowledgment that Intel is not ready to confront Nvidia directly in flagship training GPUs and is instead choosing to focus its efforts.

The article argues that Intel’s “comeback” depends largely on execution around next-generation manufacturing, competitive laptop and desktop chips with integrated artificial intelligence acceleration, and efficient server CPUs designed for artificial intelligence-heavy systems. Artificial intelligence PCs are singled out as especially important because everyday features like summaries, copilots, image generation, and voice processing can run locally without massive cloud infrastructure, giving Intel an opportunity to regain relevance at scale. Against Nvidia, Intel is portrayed as unlikely to compete in large-scale training in the near term without multiple flawless hardware generations, a robust software ecosystem, and strong networking integration. Against AMD, the fight is described as more realistic, with Intel able to compete on server CPUs, mixed CPU plus accelerator inference workloads, and enterprise procurement, even though AMD currently has more momentum in accelerators.

Looking ahead to 2026, a successful scenario for Intel would include strong server CPU sales as artificial intelligence host processors and inference engines, Gaudi winning selected cost-sensitive inference deployments, artificial intelligence PCs becoming mainstream with real on-device usage, steadily improving manufacturing execution, and a clearer, more focused artificial intelligence roadmap. The author stresses that this is not a moonshot but a grounded path if Intel delivers. For web developers and other builders, the stakes are practical: hardware competition shapes cloud pricing, inference costs, latency, and the viability of artificial intelligence features in modern applications. The conclusion is that Intel does not need to dethrone Nvidia to win; if it executes on CPUs, inference, artificial intelligence PCs, and manufacturing, it can become a strong third pillar in the artificial intelligence compute landscape by 2026-2027, giving the market more choice and improving economics for software builders.