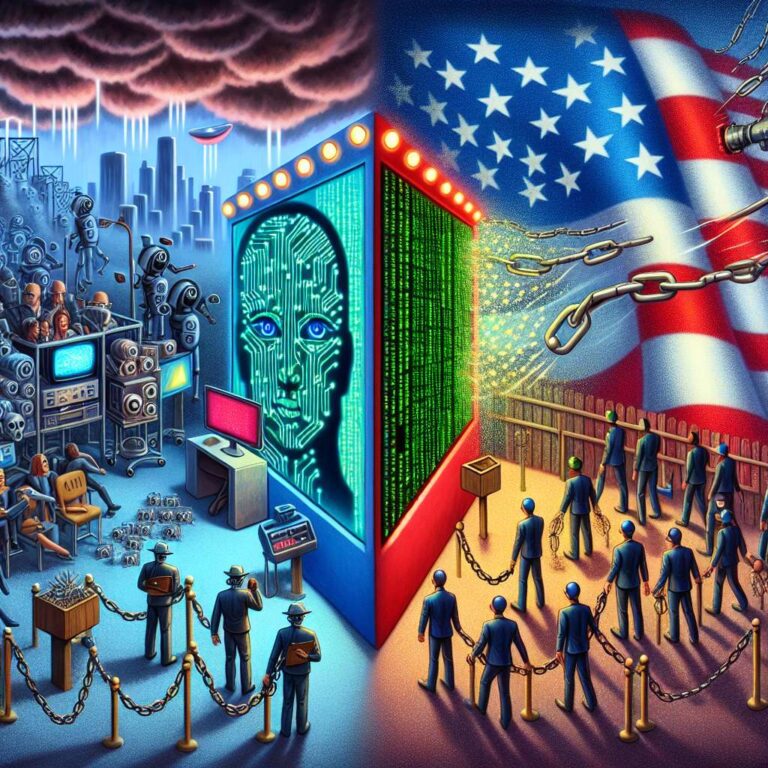

The article examines how President Trump’s recent executive order on Artificial Intelligence is poised to reshape the regulatory landscape for the technology and why this matters specifically for Hollywood. The order is framed as an attempt to establish a “national AI policy framework” while challenging state level Artificial Intelligence laws across the country, a move critics describe as a legal Hail Mary, constitutional overreach and a trigger for courtroom gridlock. Beneath the political theater, the piece argues that the real stakes involve whether the United States can maintain leadership in Artificial Intelligence innovation and rulemaking, or whether countries such as China will set the terms that could directly affect studios and the film and television business.

Throughout 2025 Trump has argued that the United States must cut regulatory “red tape” so domestic Artificial Intelligence companies do not face “50 different approvals from 50 different states” whenever they want to innovate, with California portrayed as the central battleground where Big Tech, Big Media and partisan conflict collide. He has cast state level Artificial Intelligence rules as a drag on competitiveness and insisted that a single national standard is required to “win the AI race,” a phrase the author notes can sound like campaign rhetoric until it is paired with Artificial Intelligence’s expanding role in economic growth, military modernization through tools such as Palantir’s Foundry and industrial change such as predictive maintenance of farm tools. The piece also links Artificial Intelligence’s perceived prospects to stock market performance, arguing that if Artificial Intelligence is viewed as a bubble and bursts, it could hit the broader market that has been lifted by the “magnificent seven” of Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla.

The author situates these domestic debates against accelerating progress in China, pointing to Chinese models and Artificial Intelligence applications that are gaining traction faster than many expected, helped in part by Nvidia’s Jensen Huang lobbying Trump to reverse a ban on selling H200 chips to Beijing. The article notes breakthroughs such as competitive large language models from DeepSeek and meme focused platforms like Kling that have unsettled Silicon Valley and Hollywood. It also highlights an October policy letter from OpenAI that warned Chinese Artificial Intelligence advancements are closing the gap with United States capabilities and urged changes to training data policy to keep American models ahead, along with bipartisan efforts to block Chinese Artificial Intelligence systems from federal use on national security grounds. Against this backdrop, the author argues that Trump is not entirely wrong to present Artificial Intelligence leadership as a global competition and outlines five urgent questions Hollywood should now ask, including what Gavin Newsom and studios should be fighting for, how the order could affect California’s laws, what it means for dealmaking and production, how it will reverberate in upcoming guild negotiations, and what protections the industry needs to preserve its creative culture in the age of Artificial Intelligence.