Experian´s latest findings show that more than a third of companies are using Artificial Intelligence, including generative AI, to detect and prevent fraud, while over half are adopting new analytics and building AI models to improve customer decision-making. Investment is accelerating: 70% of businesses are increasing budgets to fight fraud and nearly 60% reported higher fraud losses year on year. At the same time 90% of companies say they are worried about fraud, a pressure that is reshaping vendor roadmaps and internal risk priorities.

There is a paradox at the heart of the shift to machine learning and automation. Artificial Intelligence speeds detection and can automate responses, but it also enables new threat vectors such as deepfakes and automated impersonation. The report highlights concerns about agentic AI that can act without human intervention, noting efficiency gains alongside an expanded attack surface. Seventy two percent of business leaders expect deepfakes and similar threats to become major issues by 2026. Experian´s chief innovation officer, Kathleen Peters, summed it up by saying ´with the widespread use of generative AI, fraud is evolving faster than many businesses can keep up with´, and that firms must combine data, advanced analytics and oversight to stay ahead.

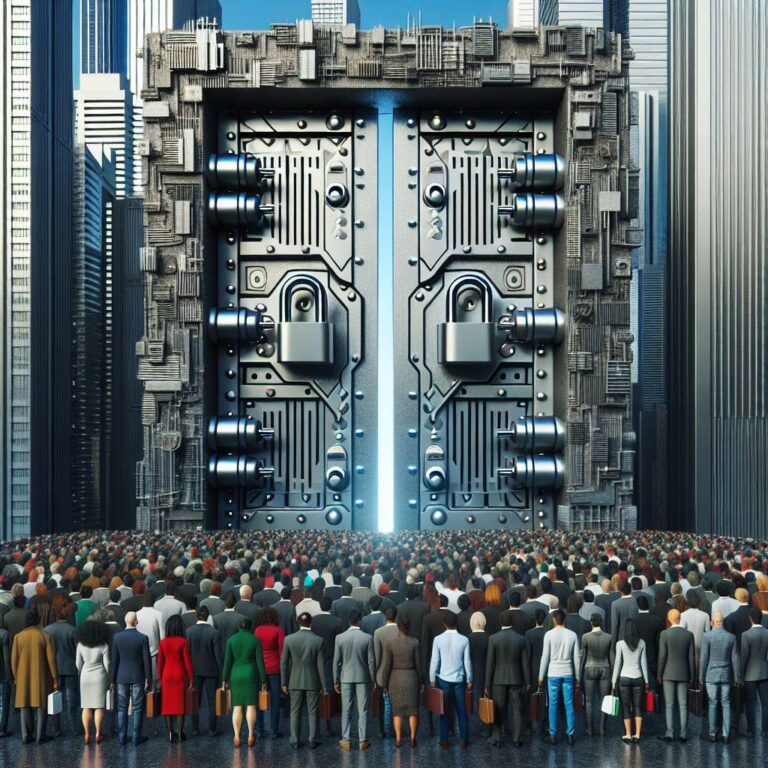

Consumer confidence has not kept pace with corporate claims. Fewer than one in four people say they have used AI tools like chatbots, and only 18% fully trust them. Consumers are uneasy: 57% remain hesitant to transact online, citing identity theft, stolen card data, privacy breaches, phishing and misinformation as top concerns. Less than half of people are highly trusting of companies to address those worries, even though 85% of businesses believe their fraud controls align with consumer expectations.

The technology gap is practical as well as perceptual. Many companies still rely on passwords and PINs, while consumers report feeling safer with biometrics and behavioral analytics, which remain underused. The conclusion is clear: deploying new tools is necessary but not sufficient. Firms must pair stronger technical controls with clearer communication and governance so customers can actually feel safer when interacting online.