From a cluster of call centers in Canada, a criminal network managed to defraud elderly individuals in the United States between 2021 and 2024, using advances in technology to make their schemes more convincing and widespread. By leveraging voice over internet protocol, fraudsters could disguise their calls as if they originated from victims´ grandchildren, customizing their manipulations through detailed personal data such as age, residence, and estimated income. The combination of these personal insights with large language models has opened the door to voice cloning, allowing criminals to mimic loved ones convincingly using only sporadic digital traces and basic software subscriptions.

The rising ease of fabricating synthetic identities, or ´Frankenstein IDs,´ now costs American banks billions annually—making this the fastest-growing financial crime. Attackers exploit massive troves of breached personal data, quickly testing thousands of stolen credentials with inexpensive software to infiltrate various platforms. Meanwhile, sophisticated text-to-speech tools powered by artificial intelligence easily circumvent security measures like voice authentication, further eroding consumer trust and safety. According to John Pitts from Plaid, technology amplifies traditional fraud while enabling entirely new forms of crime at scale, transforming the landscape of risk management for financial institutions.

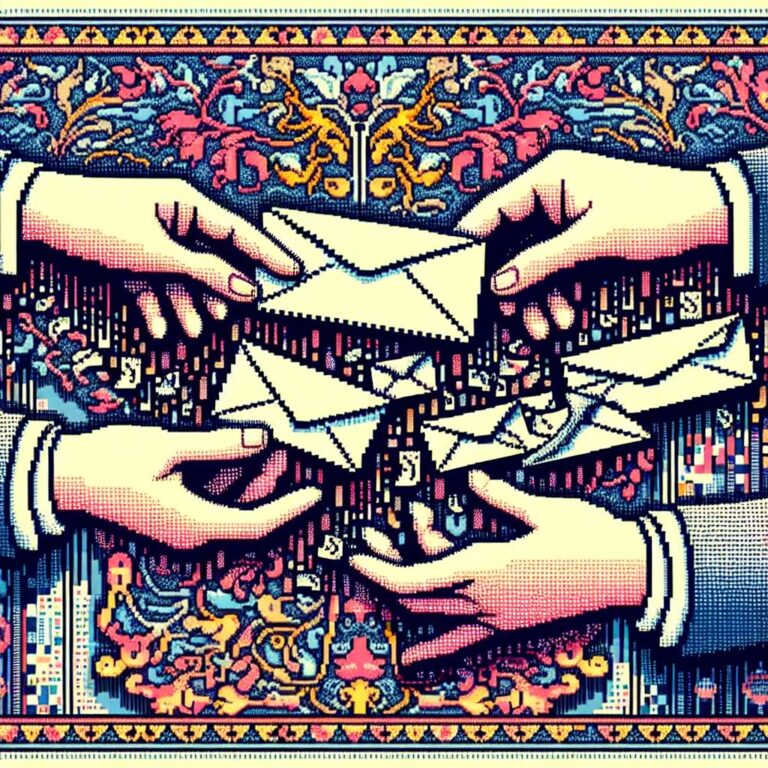

Artificial intelligence has become a force multiplier for criminals, drastically expanding the number of possible attack vectors. In scams that hinge on upfront fees for promised windfalls, attackers use artificial intelligence to target exponentially more victims with minimal overhead, automating an endless stream of personalized digital interactions. As these technologies proliferate, financial institutions, regulatory bodies, and the public must grapple with the ongoing evolution of fraud, where artificial intelligence is at once a catalyst and a transformative tool in the hands of bad actors. The arms race between defenders and fraudsters is intensifying—demanding vigilance, innovation, and cross-sector cooperation to mitigate mounting risks and curb this surge in high-tech financial crime.