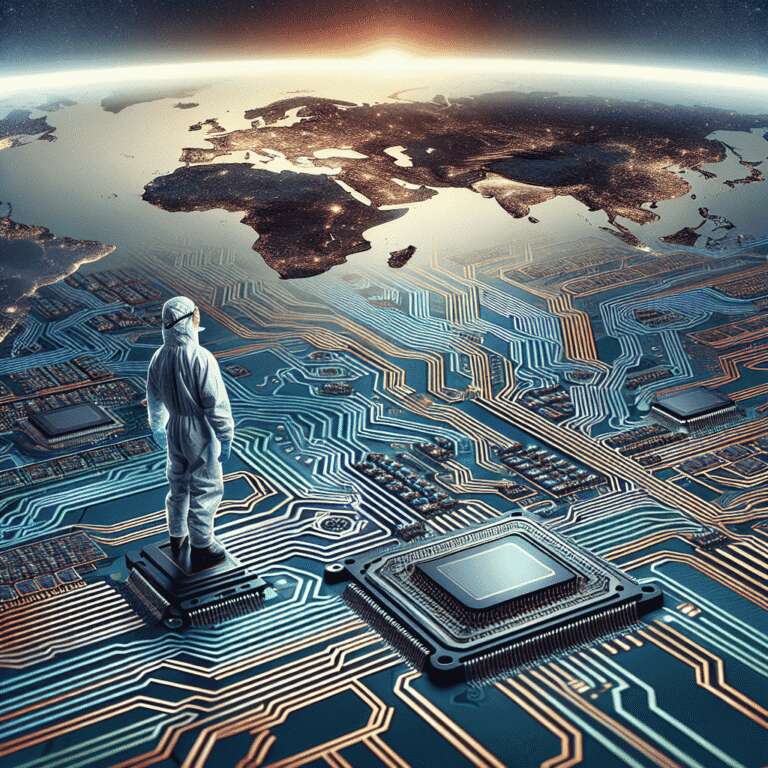

The global semiconductor industry has become a geopolitical battleground, propelled by the converging forces of U.S.-China tech competition, the rapid rise of Artificial Intelligence applications, and major shifts in global supply chains. Chips are now seen as core national assets, intertwining issues of economic sovereignty and national security. Taiwan, led by TSMC´s foundry dominance, maintains a critical position, but faces challenges from China’s domestic chip initiatives, the U.S. CHIPS Act, and cloud service providers (CSPs) like Google and AWS developing their own custom chips and accelerators. Notably, the U.S. recently restricted high-end NVIDIA GPU exports to China, aiming to slow Chinese progress in Artificial Intelligence chip development. Despite this, China’s advancements, such as Huawei’s Ascend chips and the Deepseek models, underscore a persistent technological push.

To retain its edge, Taiwan must pivot beyond pure manufacturing to develop strengths in chip design, advanced packaging, and integrated platforms—envisioning a ´Silicon Island Chain.´ Application-Specific Integrated Circuits (ASICs) are emerging as the new mainstream, owing to the immense performance and efficiency demands of large Artificial Intelligence models and next-gen communications. Traditional CPUs and GPUs increasingly fall short against these evolving workloads. In response, leading CSPs like Google (TPU), AWS (Graviton/Trainium), Meta (MTIA), and Microsoft (Cobalt) are building custom silicon, signaling a profound shift in the IC design and manufacturing landscape. Broadcom epitomizes the new B2B ASIC design model, delivering deep customization for enterprise customers and setting a high bar for Taiwanese firms aspiring to compete in advanced design services.

Taiwan’s ASIC ecosystem is robust, driven by companies such as GUC, MediaTek, Aichip Technologies, and Faraday Technology—each contributing advanced design, integration, and turnkey solutions for Artificial Intelligence, HPC, and edge applications. Strategic partnerships, particularly between TSMC and MediaTek and alliances with Artificial Intelligence leaders like NVIDIA, are key to integrating cutting-edge design, packaging (CoWoS, SoIC, UCIe standards), and emerging chiplet architectures. Looking forward, the industry is set to embrace three defining trends: modular chiplet-based architectures for cost-effective, flexible design; integration of optical I/O to meet bandwidth demands of next-gen clusters; and mainstream adoption of generative IC design tools leveraging Artificial Intelligence for rapid, automated design cycles.

These innovations will shape foundry node choices, packaging methods, and testing processes, driving a vertical integration of Taiwan’s chip industry. Chip design is transitioning from an isolated in-house function to a critical node in a global network of cross-company and regional collaboration. Taiwan’s continued leadership hinges on maintaining leverage across the entire silicon value chain, from design to platform integration, amid a swiftly evolving global semiconductor landscape.