Financial services are operationalizing Artificial Intelligence across core workflows, shifting from experiments to measurable impact. At Bankwell Bank, a Cascading AI agent named Sarah responds to applicants in minutes, gathers documents, and hands off structured files, reactivating roughly half of dormant applicants while saving loan officers 90 percent of document-collection time. Morgan Stanley’s Debrief tool automatically summarizes client calls, saving advisors 30 minutes per meeting, and JPMorgan Chase’s COIN system automates the review of 12,000 commercial loan agreements that previously consumed 360,000 hours annually. These deployments signal a focus on tangible business outcomes rather than novelty.

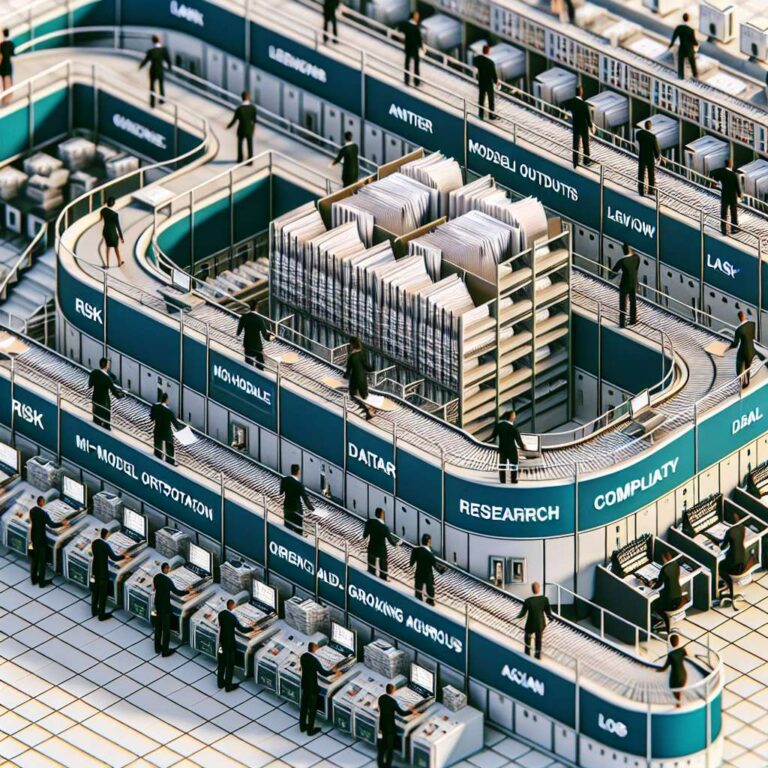

The most mature use cases target investment research, document processing, and risk functions. AlphaSense uses multi-model retrieval-augmented generation to compress sector analyses from weeks to minutes. Bridgewater Associates integrates large language model embeddings with proprietary causal models to power a machine learning fund. A new wave of autonomous systems is also emerging: Goldman Sachs is piloting “Devin” to boost routine coding productivity by 3 to 4 times, Cascading AI’s Sarah automates up to 90 percent of the lending cycle by integrating with core systems, and BlackRock’s Aladdin Copilot is evolving from a query assistant to an autonomous platform with a registry of risk and trading tools. Infrastructure and compliance underpin these efforts. Nubank built a 1.5 billion parameter transaction transformer using Ray, Rogo reports 2.42 times the accuracy of general-purpose models on finance tasks, and Morgan Stanley’s AI Assistant serves as a controlled encyclopedia for 100,000 plus internal documents. Platforms from Boosted AI and Cascading AI log all interactions for SOC2-II compliance.

Architecturally, leaders favor multi-model orchestration and retrieval-grounded design. Boosted AI’s Alfa coordinates internally tuned and third-party models from providers such as Anthropic and OpenAI in a three-layer system that runs hundreds of autonomous workers and processes billions of tokens daily. Goldman Sachs similarly routes tasks across models from OpenAI, Google, and Meta to balance cost and performance. Retrieval-augmented generation is central to accuracy: Morgan Stanley’s AI @ Morgan Stanley Assistant, built on GPT-4, answers exclusively from hundreds of thousands of pages of internal content, and AskResearchGPT synthesizes insights from more than 70,000 proprietary reports. Where specialization is required, firms like Nubank operate custom models of up to 1.5 billion parameters, reporting more than 50 percent improvements in fraud detection. Kensho at S&P Global notes that querying complex relational data remains hard for large language models without specialized layers.

Key barriers include hallucination risk, computational cost, and legacy integration. Morgan Stanley labels hallucination its most prominent risk and runs daily regression tests designed to break the model. Boosted AI adds authenticator models, while BlackRock filters Aladdin Copilot outputs to reduce misinformation or inappropriate content. Scale is another hurdle: AlphaSense processes 500 million premium documents with 300,000 added daily and uses Cerebras WSE-3 chips for 10 times faster processing; Nubank trains billion-parameter models on 64 H100 GPUs for real-time fraud detection, processing 2 billion transactions in single inference batches; Two Sigma reports 24 times reinforcement learning speedups on Ray but still faces high computational costs and GPU capex management. Bridgewater Associates highlights the complexity of connecting decades-old infrastructure to modern Artificial Intelligence pipelines, and firms must balance tech speed with banking safety amid rising infrastructure costs.

Implementation patterns are converging on modular toolkits, security-first architectures, and human oversight. Organizations avoid vendor lock-in by routing tasks to specialized or fine-tuned models, with Rogo reporting 2.42 times accuracy gains from finance-specific tuning. Two Sigma’s internal LLM Workbench is designed to prevent intellectual property leakage, and Morgan Stanley enforces zero data retention with vendors. Many combine generative reasoning with deterministic models, as Bridgewater Associates feeds large language model-derived insights into battle-tested quantitative systems. The next phase is agentic: Aladdin Copilot’s plugin architecture lets teams add tools as skills, while retrieval grounding and expert review keep outputs auditable. Competitive advantage now hinges on how effectively firms architect and govern these intelligent systems.