The UK financial services sector is experiencing its most acute technology skills shortage in more than 15 years, propelled by the accelerating integration of artificial intelligence across the industry. According to the latest Harvey Nash digital leadership report, artificial intelligence has climbed from the seventh to the most scarce technology skill in just 18 months, marking a 260 percent rise in reported shortages. Experts warn that unless this talent gap is addressed within the next 12 to 18 months, the UK´s reputation as a global leader in financial services and financial technology could be at risk.

While 89 percent of technology leaders in financial services confirm investments in artificial intelligence—up from 43 percent the previous year—companies are not matching this with sufficient workforce development. Over half of surveyed organizations are not providing training in generative artificial intelligence, resulting in a significant lag between technological advancements and employee skill sets. Larger organizations with substantial technology budgets are better positioned, with 44 percent reporting measurable returns on artificial intelligence investments, compared to 27 percent across the broader sector. This disparity points to an emerging competitive divide, as well-resourced firms are more capable of capitalizing on artificial intelligence adoption.

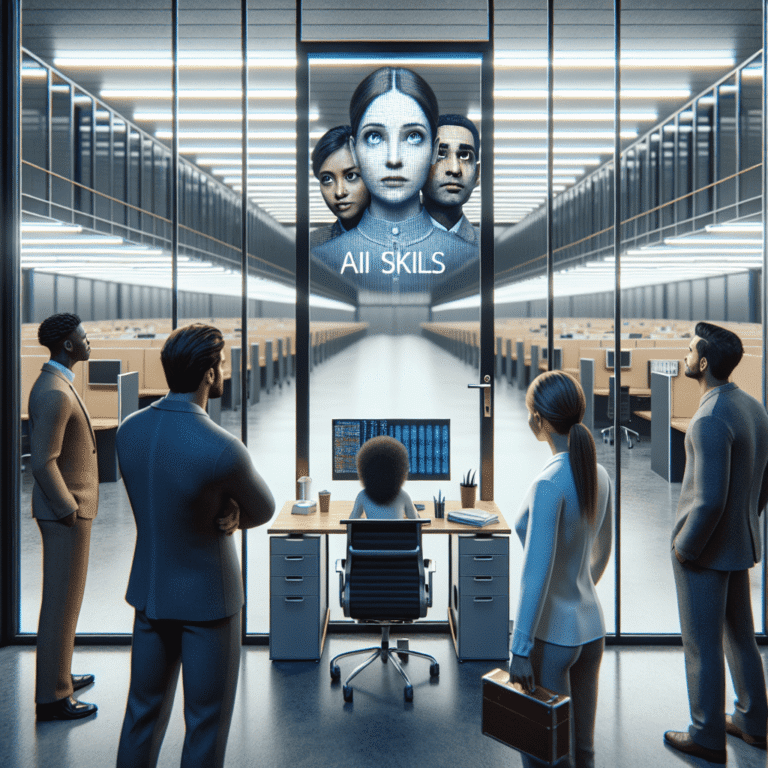

The race for artificial intelligence talent is driving financial institutions to recruit from large technology companies already advanced in the field, while banks are also seeing internal demand from software engineers seeking to build artificial intelligence expertise. Engaging Gen Z workers is proving advantageous: firms who successfully involve younger employees are twice as likely to be prepared for artificial intelligence demands and 56 percent more likely to achieve measurable returns. Industry leaders predict that by 2030, banking technology teams will be smaller but more proficient in working with artificial intelligence tools and specialist engineers. However, the swift pace of artificial intelligence deployment has left regulatory frameworks trailing, with only a fraction of firms prepared for new rules and many establishing their own controls in the absence of comprehensive guidance. This regulatory lag poses additional challenges to the effective and responsible implementation of artificial intelligence in UK finance.