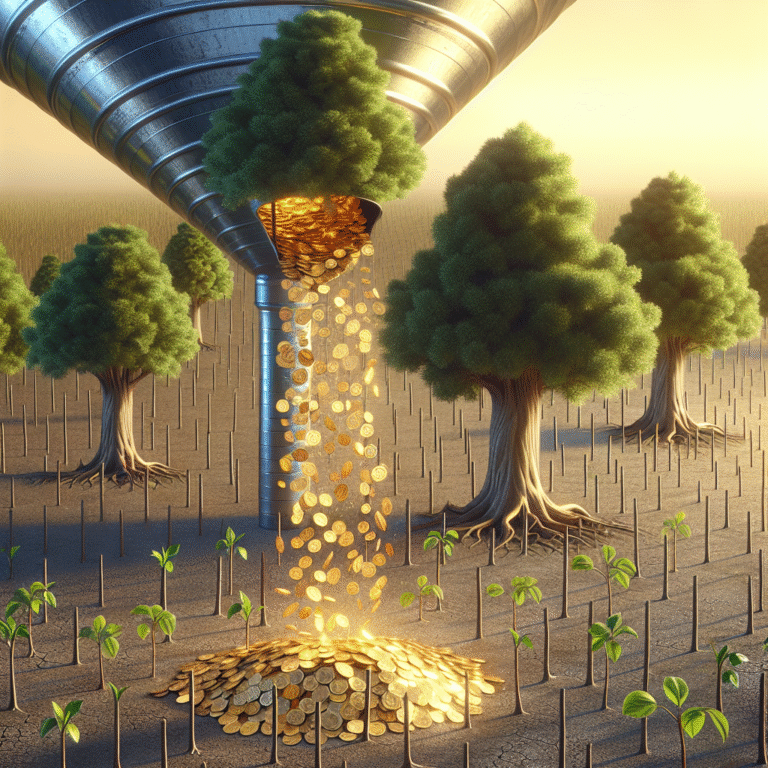

Venture capital investment in US startups has undergone a significant transformation, with the majority of funding increasingly concentrated in a handful of massive rounds for mature companies, rather than being spread among early-stage ventures. This trend was especially apparent in the first quarter of 2025, when a single record-breaking financing deal for OpenAI accounted for nearly half of all US startup funding in that period. Data compiled by Crunchbase reveals a steady increase over the past three years in the proportion of total startup funding that is funneled into the ten largest reported rounds each year.

Artificial Intelligence companies have been at the forefront of this fundraising surge. Notable recipients of multi-billion-dollar rounds include OpenAI, xAI, and Anthropic, while other technology leaders like Waymo, Databricks, and Anduril also attracted substantial investments, often linked to their Artificial Intelligence-driven initiatives. Health and life sciences, conversely, have been underrepresented in the list of top mega-rounds, with no companies from those sectors appearing among the 20 largest rounds of the past two years, though AI-focused drug discovery startup Xaira secured a sizable equity financing.

The preference for investing in established startups reflects a broader shift in the risk-reward assessment by venture capitalists. While early-stage investments in companies like Facebook and Google historically yielded outsized returns, such successes remain rare; most seed-stage startups fail to scale. As limited partners demand quicker and safer returns, investors are increasingly opting for big bets on already high-profile private companies, even at lofty valuations that exceed the market capitalizations of established public firms such as Samsung, Toyota, and McDonald’s. This dynamic, epitomized by the latest rounds for OpenAI and its peers, signals an era where the largest startups absorb an ever-growing share of available venture capital.