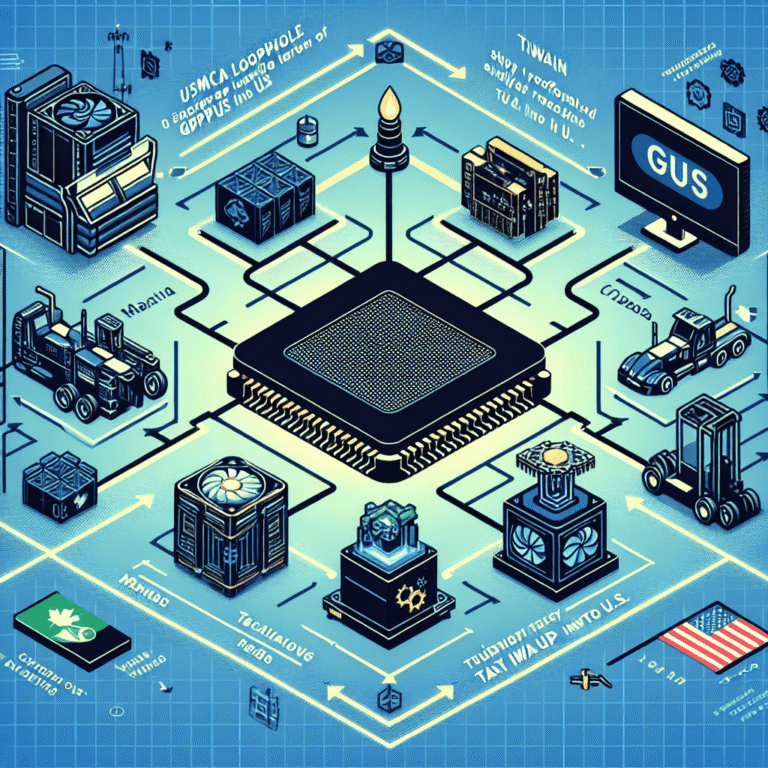

A recently identified loophole in the United States-Mexico-Canada Agreement (USMCA) allows high-performance GPUs manufactured in Taiwan to enter the US market without incurring the 32% import duties imposed on direct shipments from Taiwan. This workaround, uncovered by research firm SemiAnalysis, enables technology companies to route these Taiwan-made GPUs through assembly operations in Mexico or Canada. Once these GPUs undergo final assembly in North American facilities, they qualify for tariff exemptions under specific Most-Favored-Nation clauses within the USMCA.

The legal foundation of this exemption lies in the USMCA’s broadened classification of what constitutes an ´originating good.´ Under harmonized tariff schedule codes HTS 8471.50 (digital processing units), HTS 8471.80 (automatic data processing machine units), and HTS 8473.30 (associated components), products are treated as North American in origin regardless of where their main components were manufactured. This creates a path for NVIDIA’s HGX boards, GB200 baseboards, and RTX graphics cards to avoid high tariffs when shipped to the US if final assembly occurs in Canada or Mexico, rather than in the country of origin.

This strategy builds on two recent policy directions. First, President Trump´s March 7 executive orders preserved the USMCA’s established duty-free status for goods from Canada and Mexico. Second, the USMCA’s inclusive definition of originating products allows technology companies to structure their logistics in a way that counters the impact of trade tensions. Although this approach increases the complexity of global supply chains, especially for US technology firms focused on Artificial Intelligence workloads, the elimination of steep import duties justifies the logistical shifts. The move echoes long-standing precedents in agricultural trade, where products gain tariff exemptions through partial processing or assembly in North American Free Trade partners´ territories. As the global supply chain adapts, the effectiveness and breadth of this loophole´s use remain to be seen, especially amid evolving international trade policies targeting advanced computing hardware.