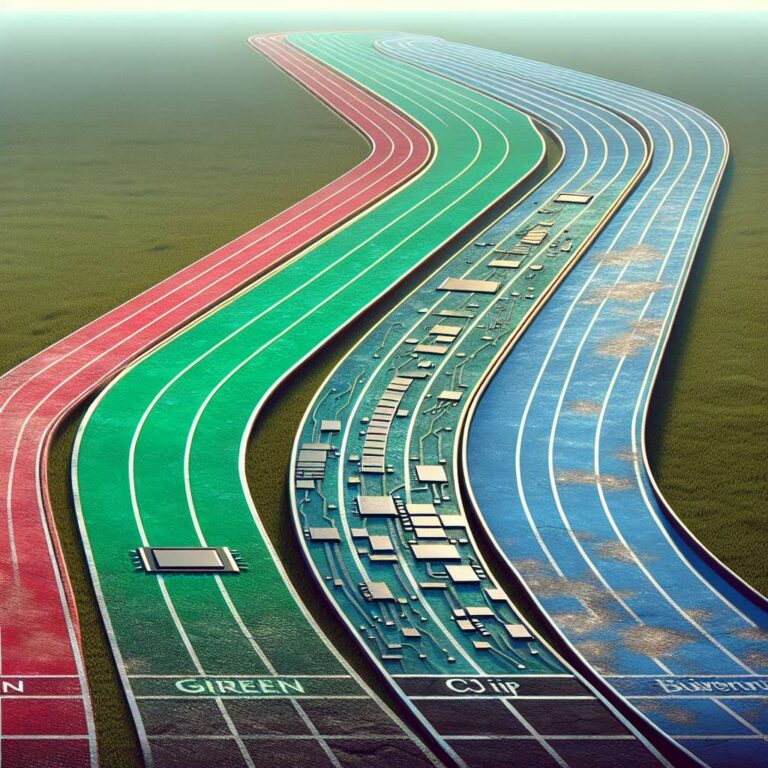

Artificial intelligence has emerged as the decisive force altering competitive dynamics among semiconductor giants Nvidia, AMD, and Intel. Once primed to lead the datacenter revolution, Intel and AMD now find themselves trailing as Nvidia’s calculated strategies reshape the industry’s balance of power. The business strategies of these three key players have recently diverged, fueling a rivalry that continues to intensify amid exponential demand for advanced compute hardware.

Nvidia’s relentless focus on AI-centric hardware innovation has allowed it to surge ahead, outpacing competitors with powerful data center chips—dominating not only through technical prowess but also through its broader platform ecosystem and software stack. In contrast, AMD and Intel, despite their technical capabilities and deep roots in traditional computing sectors, have struggled to match Nvidia’s software integration, agile roadmap execution, and market foresight. Their approaches have often relied on catching up to Nvidia’s pace, and while their advancements—such as AMD’s MI300 and Intel’s Gaudi accelerators—highlight significant engineering, they have yet to gain similar traction or industry mindshare.

This strategic divergence is evident in enterprise adoption trends, as hyperscale cloud providers and next-generation AI startups consistently gravitate toward Nvidia solutions for edge and data center deployments. Intel and AMD face the challenge of not just competing on raw chip performance, but also closing gaps in ecosystem enablement and developer toolchains critical to scaling artificial intelligence workloads. As Nvidia sets the benchmark for what next-generation semiconductor success looks like, the company’s progress compels AMD and Intel to re-evaluate their go-to-market and innovation strategies. The implications of this rivalry reach far beyond individual market share—they signal a transformation in the very fabric of the semiconductor landscape.