This week, 67 US startups secured equity funding in a robust early 2025 environment widely driven by Artificial Intelligence. Despite the omission of specific dollar amounts, the report points to a surge in startup investment, with North America experiencing its best half-year fundraising total since 2022. Artificial Intelligence proved to be the dominant sector, absorbing nearly half of global Q2 venture capital, and playing a significant role in key rounds such as Parspec’s Series A. Biotechnology and Automotive were also strong performers, reflecting lasting confidence in innovation across health and mobility.

Series B and Series A rounds accounted for the largest share of capital, underscoring investor appetite for scaling companies with proven traction. Among the standouts were LangChain and Harmonic (both Artificial Intelligence, Series B), ServiceUp (Automotive, Series B), and RealSense (Computer vision, Series A, spun out from Intel)—all based in California. Seed and pre-seed deal flow remained brisk, signaling a healthy entrepreneurial pipeline and broad-based early-stage activity. Renasant Bio and Hexium´s seed rounds illustrate ongoing willingness to back nascent ideas at formative stages.

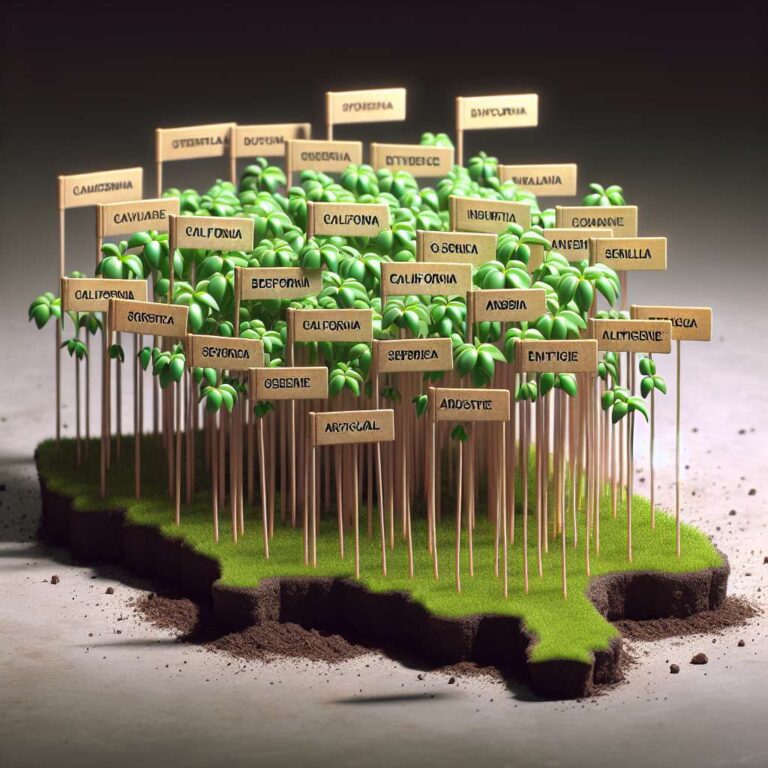

The data reveals California´s sustained dominance, with the state attracting the majority of capital and high-profile deals, consolidating its role as America’s primary tech hub. New York trailed as the second-largest destination for startup investment, highlighted by analytics firm Moment’s sizeable Series B, while New Jersey also garnered attention due to Agora’s notable Series A. Investment activity, while concentrated, is geographically diverse: more than 20 states saw some venture action, with Utah, Virginia, and Texas emerging as minor hotspots.

Investor sentiment appears strongly aligned with scaling opportunities and technological breakthrough, especially for Artificial Intelligence and Biotechnology. The upswing in M&A and IPO activity further reflects growing venture market confidence, suggesting startups now have improved prospects for both growth capital and exits. The landscape remains competitive, but the focus on scaling and the migration of capital towards advanced technologies and established regions indicates investors are zeroing in on perceived winners—with Artificial Intelligence at the epicenter of the US innovation engine.